Business Valuation

It is normal for a Business Owner to want to know what their company is worth as it is most probably the largest asset they own. Business valuation goes beyond simple mathematics and is what one might call a “subjective science.”

It is normal for a Business Owner to want to know what their company is worth as it is most probably the largest asset they own. Business valuation goes beyond simple mathematics and is what one might call a “subjective science.”

The science part of business valuation is what people go to school to learn. One can get an MBA or a degree in finance, or learn the theory behind business valuation and earn professional credentials as a Business Valuation professional. The subjective part of business valuation is that every Buyer’s circumstance is different, and therefore two Buyers could see the same set of company financials and offer vastly different amounts to buy a business.

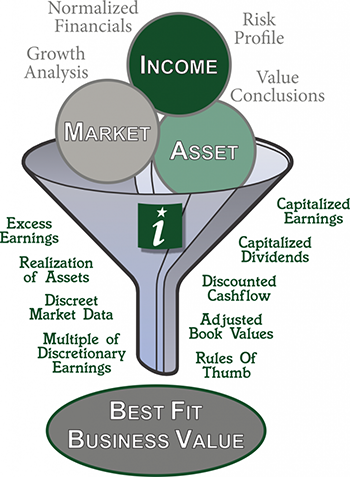

The following provides the basic science and math behind the most common business valuation techniques, but keep in mind that there will always be outliers that fall well outside of these frameworks. The main outlier is a strategic sale, where a business is many times over valued based on what it is worth in the acquirer’s hands. Strategic acquisitions represent a minority of acquisitions however, so the three methods below triangulate around what is most commonly used in determining a realistic value for a company:

Asset Based Valuation

The most basic way to value a business is to consider the sum of its hard assets minus debts. Imagine a landscaping company with trucks and gardening equipment. These hard assets have value, which can be calculated by estimating the resale value of the equipment.

This valuation method often renders the lowest value for a business because it assumes the company does not have any “Good Will.” In Accountant/CPA speak, “Good Will” has nothing to do with how much people like a business; Good Will is defined as the difference between a business’s market value (what someone is willing to pay for it) and the value of net assets (assets minus liabilities).

Typically, businesses have at least some Good Will, so in most cases a higher valuation is attained by using one of the other two methods described below.

Discounted Cash Flow Valuation

In this method, a Buyer is estimating what the future stream of business cash flow is worth to them today. They start by trying to figure out how much profit a business can expect to make in the next few years. The more stable and predictable the cash flows, the more years of future cash they will consider.

Once a Buyer has an estimate of how much profit a business is likely to make in the foreseeable future, and what the business will be worth when they want to sell it in the future, the Buyer will apply a “discount rate” that takes into consideration the time value of money. The discount rate is determined by the Buyer’s cost of capital and how risky they perceive a business to be.

Rather than getting hung up on the math behind the discounted cash flow valuation technique, it’s better to understand the drivers of value when using this method. The key drivers of value are: 1) how much profit a business is expected to make in the future; and 2) how reliable those estimates are.

Note that business valuation techniques are either/or and not a combination. For example, when using Discounted Cash Flow, the hard assets of a business are assumed to be integral to the generation of the profit the Buyer is acquiring and therefore not included in the calculation of a business’s value.

A money-losing Bed & Breakfast sitting on a $2 million piece of land is going to be better off using the Asset Based Valuation method. In contrast, a Professional Services firm that expects to earn $500,000 in profit next year, but has little in the way of hard assets, will garner a higher valuation using the Discounted Cash Flow method or the Comparable Valuation Technique described below.

Comparable Valuation Technique

Another common valuation technique is to look at the value of comparable businesses that have sold recently or for whom their value is public. For example, Accounting Firms are known to typically trade at one times gross recurring fees. Home & Office Security Companies trade at about two times monitoring revenue, and most Security Company owners know about the Comparable Valuation Technique because they are often approached to sell by Private Equity Firms rolling up businesses of a similar nature. Many times, one can find out what businesses in a specific industry are selling for by asking around at an annual industry conference.

The problem with using the Comparable Valuation Technique is that it often leads owners to make an apples-to-bananas comparison. For example, a small Medical Device Manufacturer might think that, because GE is trading for 20 times last year’s earnings on the New York Stock Exchange, they too are worth 20 times last year’s profit. However, if one looks at “true” comparable businesses – many factors including size, location, age and value of assets to name a few – a much different picture would be created resulting in a significantly different overall value in the open marketplace. Small business is deeply discounted when compared to their Fortune 500 counterparts, so comparing a small business with a Fortune 500 giant will lead to Business Owners to disappointment when comparing valuations.

Conclusion

The worst part about selling a business is that the Business Owner doesn’t get to decide which methodology a Buyer chooses. A Buyer will do the math on what a business is worth to them behind closed doors. They may decide a business is strategic, in which case the valuation could be significantly higher than expected. In most cases, however, a Buyer will use one of the three techniques described above to come up with an offer to buy a business.

The key is to increase the value of your business by hiring a firm that can best develop, then represent both the inherent and intrinsic value of your business. Curious to see what your business might be worth?